Welcome to Kingmont Consulting, Professional Corporation

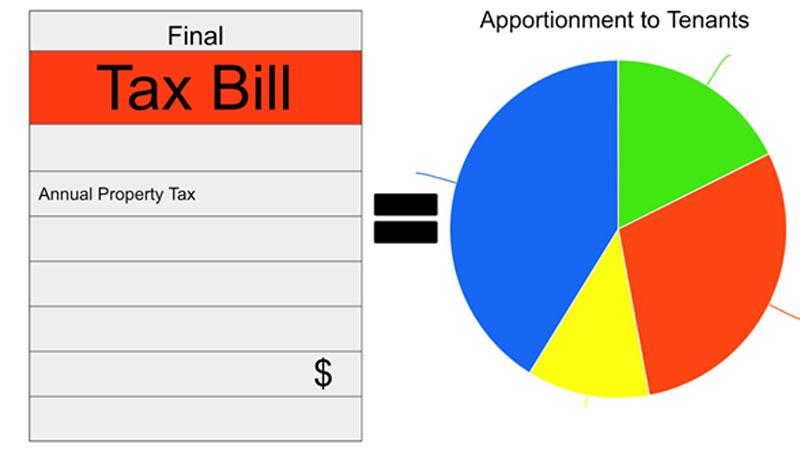

Apportionment and Tax Allocation

The interests of the landlord and the tenant are not always aligned. An independent review and inquiry into the responsibilities of each party and of tax allocation schedules is often required. These reviews confirm the landlord’s calculation and support the amounts payable by the tenant. A change to the apportionment of the taxes or portion of the refund may make a difference to either the landlord or tenant's bottom line. We have worked on behalf of property owners and tenants alike.

Kingmont Consulting

Small firm service, large firm expertise. Kingmont has been a leader in the property tax industry for more than 40 years.

Tech Availability

Zoom, Teams & Dedicated Conference lines